As tax season approaches, businesses are laser-focused on preparing financial documents, filing returns, and meeting tight deadlines. Unfortunately, cybercriminals see this as the perfect opportunity to strike.

As tax season approaches, businesses are laser-focused on preparing financial documents, filing returns, and meeting tight deadlines. Unfortunately, cybercriminals see this as the perfect opportunity to strike.

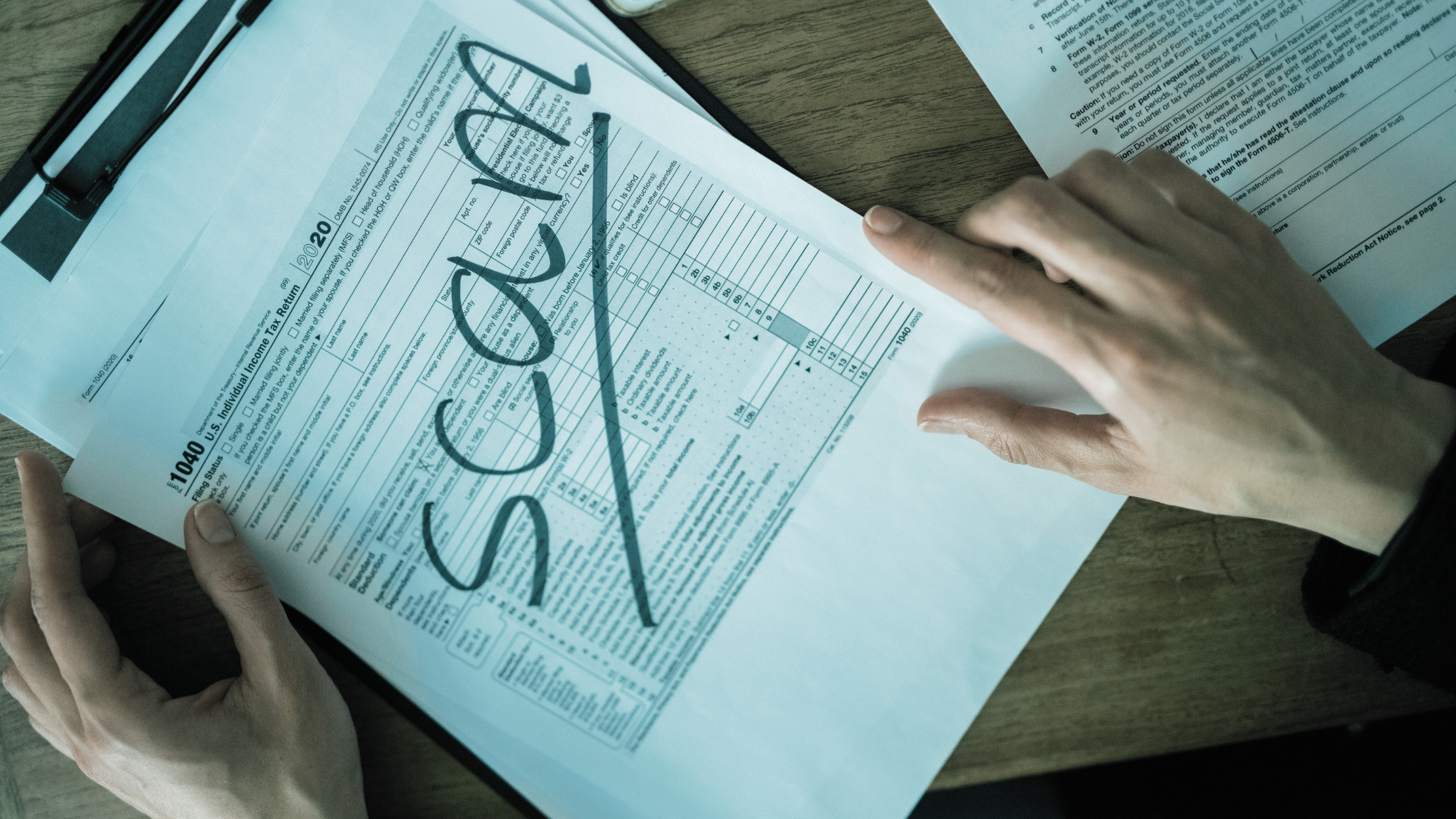

Hackers target busy businesses, looking for ways to exploit sensitive financial data, launch scams, and create chaos. Without strong cybersecurity measures in place, your company could be at risk for fraud, data breaches, and costly downtime.

In this blog, we’ll uncover why tax season is prime time for cyberattacks and how you can stay one step ahead to protect your business.

Why Cybercriminals Love Tax Season

1. High Volume of Sensitive Data Transfers

During tax season, businesses frequently exchange sensitive financial and personal information with accountants, payroll providers, and the IRS. These transactions create multiple entry points for cybercriminals, who exploit vulnerabilities in unsecured email communications and outdated systems.

2. Deadline Pressure Leads to Costly Mistakes

When employees are rushing to meet tax deadlines, they are more likely to overlook security red flags. Clicking on a suspicious email link, opening an attachment from an unverified sender, or falling for an urgent payment request can expose your business to fraud or ransomware attacks.

3. A Surge in Phishing and Impersonation Scams

Cybercriminals craft convincing phishing emails that impersonate trusted organizations like the IRS, tax professionals, or financial institutions. These scams trick employees into revealing login credentials, downloading malware, or making fraudulent payments.

4. Fake Invoices and Payment Scams

Fraudsters send fraudulent invoices or wire transfer requests that appear to come from legitimate sources. If your accounting team isn’t carefully verifying requests, your business could unknowingly send money directly to hackers.

Top Tax Season Cybersecurity Threats

- Phishing Emails – Fake IRS notifications, fraudulent tax preparer emails, and account security alerts designed to steal credentials or install malware.

- Ransomware Attacks – Hackers encrypt critical financial data and demand a ransom for its release.

- Business Email Compromise (BEC) – Cybercriminals pose as executives, accountants, or vendors to manipulate employees into transferring money or revealing confidential information.

- Social Engineering Scams – Fraudulent phone calls and emails from scammers posing as accountants, payroll providers, or even the IRS to extract sensitive business data.

How to Protect Your Business This Tax Season

1. Educate and Train Your Employees

Your team is your first line of defense. Ensure they are trained to:

- Recognize phishing emails and suspicious tax-related messages.

- Verify email senders before opening attachments or clicking on links.

- Be cautious of urgent payment requests or unexpected financial account updates.

- Report suspicious emails to your IT department immediately.

2. Secure Financial Communications

Never send sensitive tax documents or financial information via unencrypted email. Instead:

- Use secure file-sharing tools and encrypted email services.

- Restrict access to financial data to only essential personnel.

- Implement data loss prevention (DLP) measures to prevent unauthorized sharing.

3. Implement Multi-Factor Authentication (MFA)

Adding an extra layer of security can stop cybercriminals even if they steal a password. Ensure that MFA is enabled for:

- Email accounts

- Financial software and payroll systems

- Any platform used for tax-related transactions

4. Perform a Cybersecurity Audit

Don’t wait until after an attack to assess your security. Schedule a cybersecurity audit with a trusted IT provider to:

- Identify and patch system vulnerabilities.

- Ensure all software is updated with the latest security patches.

- Strengthen endpoint security for all workstations and mobile devices.

- Verify the integrity of data backups to ensure quick recovery from attacks.

5. Double-Verify Financial Requests

Before processing any tax-related payments or wire transfers:

- Confirm requests via a second communication method (e.g., a phone call).

- Train staff to spot inconsistencies in financial emails.

- Implement an approval process for large or unusual financial transactions.

Don’t Let Hackers Win This Tax Season

Cybercriminals thrive on businesses being distracted and unprepared. By staying vigilant, educating your team, and proactively strengthening your cybersecurity, you can prevent costly data breaches and financial losses.

Take action now! Start with a FREE Network Assessment to identify vulnerabilities in your system and ensure your business is secure this tax season.

Schedule Your FREE Network Assessment Today!