February hits and suddenly every small business is in tax mode.

February hits and suddenly every small business is in tax mode.

Your CPA is asking for reports. Payroll is double-checking records. HR is pulling employee files. Owners are scanning calendars for filing deadlines.

What almost nobody schedules?

Cybercriminals.

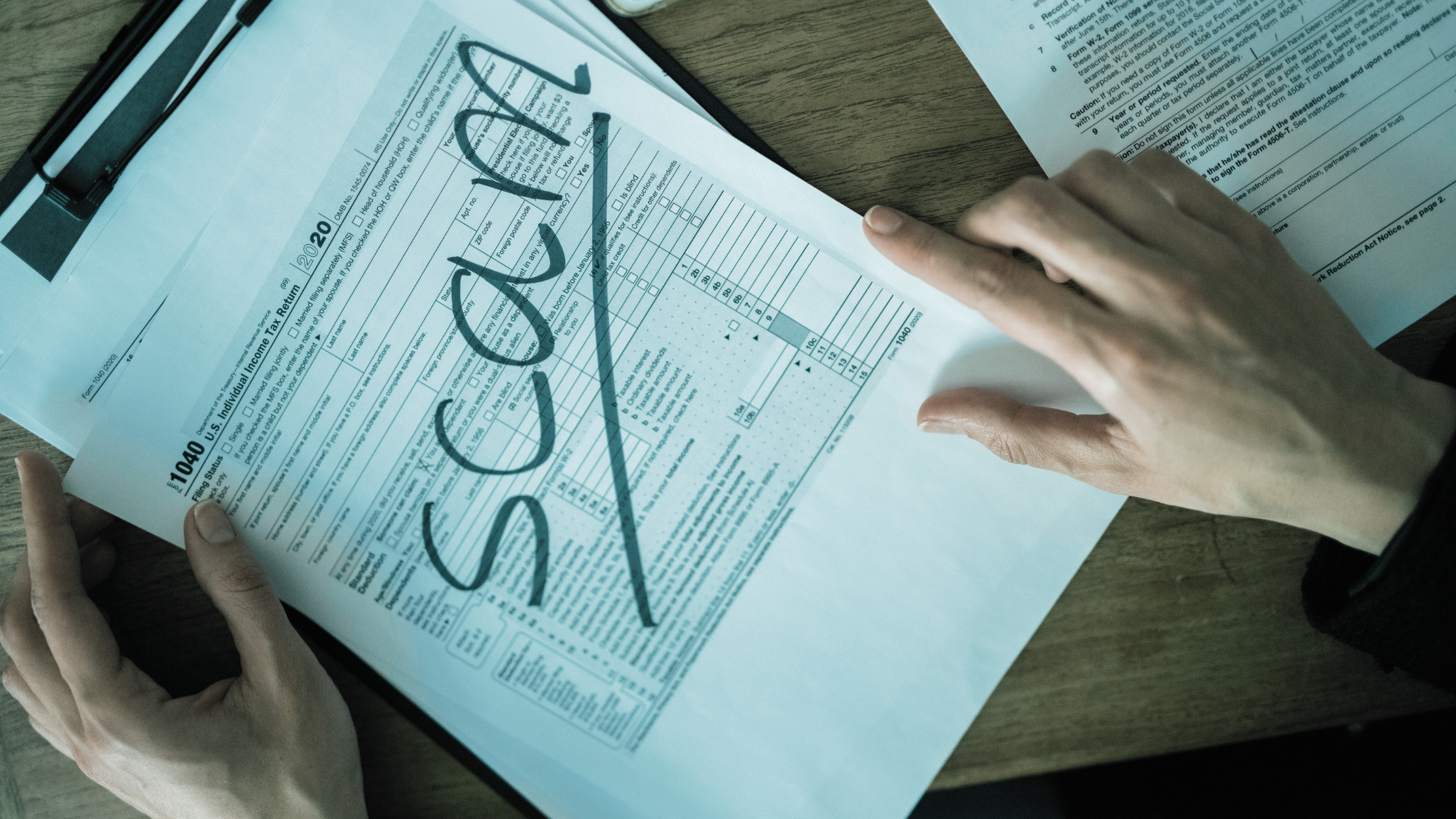

Every year, small business tax season scams surge long before April 15—and one of the first attacks to appear is simple, believable, and devastating if it works.

It’s the W-2 phishing scam.

And it targets the exact people inside your company who are already overwhelmed.

The W-2 Scam: How It Works

The setup is painfully ordinary.

Someone in payroll or HR receives an email that looks like it came from the owner, CEO, or a senior executive.

The message is short and urgent:

“Hey — I need copies of all employee W-2s for a meeting with the accountant. Can you send them ASAP? I’m slammed today.”

It feels natural.

It’s February. W-2 requests make sense. The sender looks familiar. The tone sounds right.

So the employee sends the files.

Except the email wasn’t from leadership.

It came from a criminal using:

-

A spoofed email address

-

A look-alike domain name

-

A compromised executive mailbox

Now that attacker has your employees’ most sensitive data:

-

Full legal names

-

Social Security numbers

-

Home addresses

-

Salary information

That’s everything needed for identity theft and fraudulent tax returns.

What Happens After the Data Is Stolen

Most companies don’t realize anything went wrong until employees try to file their taxes.

Suddenly refunds are rejected.

IRS notices show someone already filed using their Social Security number.

Now your staff is dealing with:

-

IRS identity-theft affidavits

-

Credit monitoring

-

Fraud alerts

-

Frozen credit files

-

Months of paperwork

Multiply that by dozens—or hundreds—of employees.

Now imagine explaining to your team that their personal data was leaked because of one email.

That’s not just an IT incident.

That’s an HR crisis.

A legal risk.

A morale killer.

A reputational problem.

Why Small Business Tax Season Scams Work So Well

This isn’t a sloppy spam message.

These scams succeed because criminals understand how small businesses operate.

Timing is perfect.

February is prime W-2 season. No one is surprised by payroll requests.

The ask is reasonable.

It’s not a wire transfer or gift cards. These documents really do get shared.

Urgency feels normal.

Executives are busy. “Send this quick” doesn’t raise alarms.

The sender looks legit.

Attackers research leadership names, job titles, and accounting vendors.

Employees want to help.

Especially when the request appears to come from the boss.

That mix makes W-2 scams one of the most successful tax-season attacks against small businesses every year.

How to Protect Your Business Before the First Email Lands

The good news?

This is one of the easiest small business tax season scams to stop—if you put a few rules in place now.

1. Create a “No W-2s via Email” Policy

W-2s and payroll files should never be emailed as attachments.

No exceptions.

Even if the message looks like it came from the CEO.

2. Require Second-Channel Verification

Any request for payroll data gets confirmed another way:

-

Phone call

-

In-person conversation

-

Teams/Slack message

-

Known internal number

Never reply directly to the email.

Thirty seconds of verification can prevent months of cleanup.

3. Hold a Quick Tax-Season Scam Briefing

Spend ten minutes reminding payroll and HR:

-

These scams spike every February

-

This is what they look like

-

This is how to respond

Awareness is cheap insurance.

4. Lock Down Payroll Systems

Every system touching employee data should require multi-factor authentication (MFA).

If credentials get phished, MFA often stops the attacker cold.

5. Reward Caution

Employees who double-check executive requests shouldn’t feel awkward.

They should feel supported.

When questioning is encouraged, scams lose power.

The Bigger Picture: This Is Only the Beginning

The W-2 scam is usually the first wave.

From February through April, small businesses are hit with:

-

Fake IRS payment notices

-

Phony tax-software updates

-

Spoofed accountant emails

-

Malware-laced attachments

-

Fake invoices disguised as tax expenses

Criminals love tax season because everyone is rushed and financial requests seem routine.

Companies that survive cleanly aren’t lucky.

They’re prepared.

They have policies.

They train employees.

They’ve hardened email systems.

If you want a baseline review of your defenses, ILER offers a free assessment here: https://iler.com/analysis/

For official IRS guidance on W-2 phishing schemes, see: https://www.irs.gov/newsroom/irs-warns-employers-about-w-2-phishing-scam

Is Your Business Ready for Tax-Season Attacks?

If your team already knows what to look for and your policies are documented—excellent. You’re ahead of most small businesses.

If not, now is the moment.

Not after payroll data leaks.

Not after employees get hit with identity theft.

A short Tax Season Security Check can review:

-

Payroll and HR access controls

-

MFA enforcement

-

Email spoofing protections

-

Verification procedures

-

The one policy most companies forget

Because tax season is stressful enough without cybercrime piled on top.