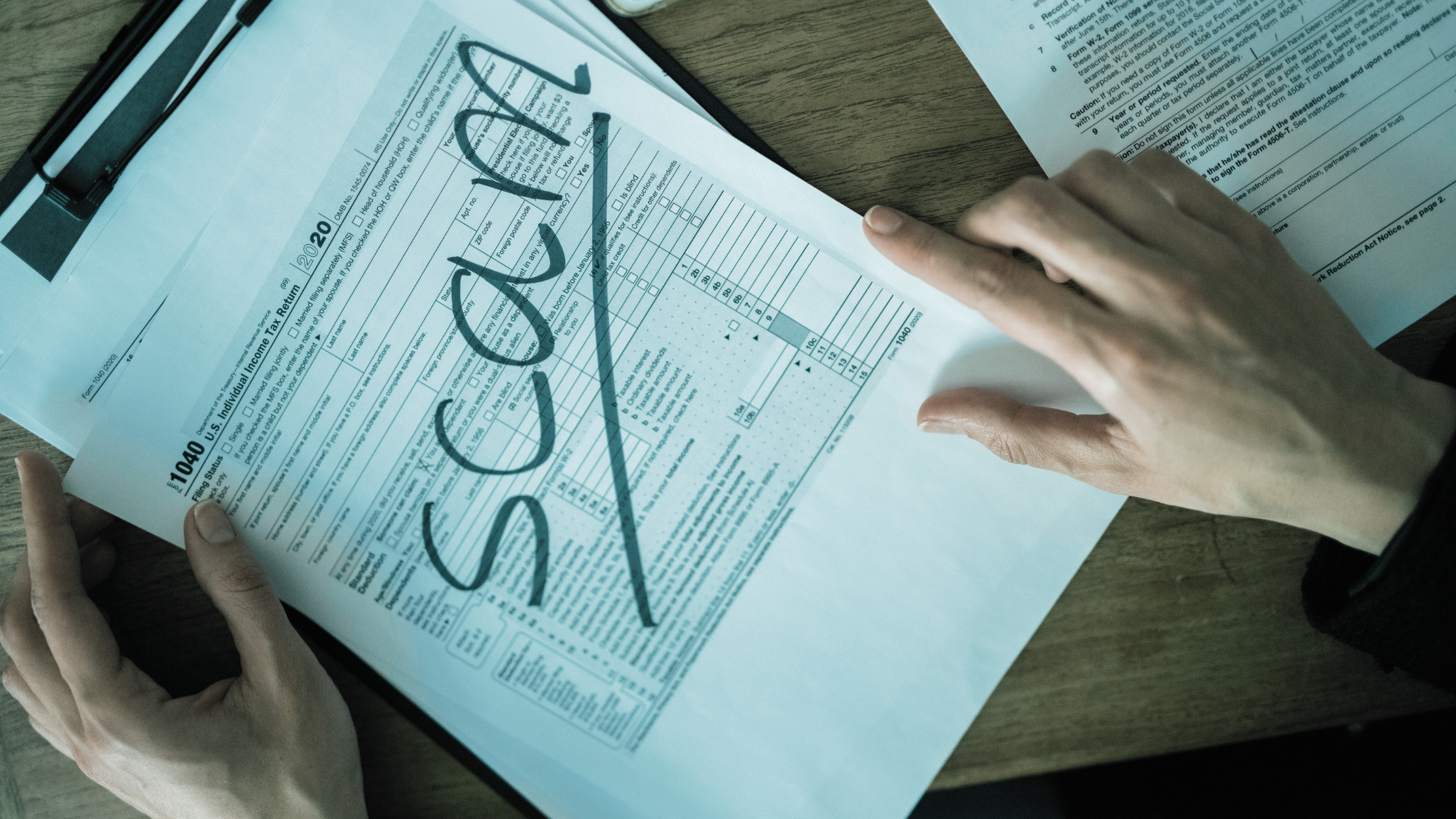

The Hidden Cost of Holiday Scam Losses — Is Your Business Next?

The Hidden Cost of Holiday Scam Losses — Is Your Business Next?

Last December, an accounts-payable clerk at a midsize firm received an urgent text purportedly from the CEO: “Buy $3,000 of Apple gift cards for clients, scratch the backs, email me the codes.” It seemed odd, but it came from the boss’s name and it was peak holiday chaos. By the time she paused to double-check, the gift cards were gone—and the business was left eating the loss.

While that gift-card scam hurt, others can absolutely ruin a business. Around the same time, Luxembourg-based chemical manufacturer Orion S.A. fell victim to a devastating fraud: what looked like legitimate vendor wire-transfer requests were processed. Result? $60 million in holiday scam losses—several major transfers, more than half the company’s annual profit gone in a flash.

If you’re thinking “that only happens to big firms,” think again. Holiday scam losses aren’t reserved for enterprise corporations—they’re increasing for firms of all sizes, especially during the busy year-end season. Let’s dive into what your team must know.

Why Holiday Scam Losses Spike This Time of Year

-

Peak Season Distractions & Urgency – As staff scramble to meet end-of-year deadlines, make last-minute purchases and process heavy transaction volumes, scammers exploit that urgency.

-

Prepayment & Vendor Cycle Shifts – Year-end invoices, changing bank details and vendor payments are routine. Scammers impersonate familiar suppliers or execs and piggy-back on real processes.

-

Gift Cards & Employee Incentives – The “holiday appreciation” angle is a favorite. According to industry data, a large portion of business-email-compromise (BEC) attacks include gift cards or prepaid instruments.

-

Sophisticated Social Engineering – These aren’t generic phishing blasts. They’re carefully crafted, impersonating executives, vendors or internal threads. In many cases, the email chain appears normal until a change is introduced.

Holiday scam losses are real, growing and potentially business-ending. According to the FBI Internet Crime Complaint Center, BEC schemes have exposed organizations to tens of billions of dollars in losses.

5 Holiday Scams That Lead to Holiday Scam Losses (and What to Do)

**1. “Your Boss Needs Gift Cards” (The Text Trap)

**The scam: Scammers impersonate executives and instruct employees (often in finance or AP) to buy gift cards and send the codes.

Prevention: Enforce a strict policy: no gift cards based on text/IM alone. Require two-person approval and email verifying purchase purpose.

**2. Invoice / Bank Detail Switch-Ups (The Big Money Move)

**The scam: Criminals hijack vendor email threads or send a “change of banking details” just as year-end payments are due. One case spelled half-million-dollar loss for a town government.

Prevention: Whenever banking details change, confirm via a separate channel using a known number (not the one in the email). Set a threshold (e.g., $5,000) above which a phone-call confirmation is required.

**3. Fake Shipping or Delivery Notices

**The scam: Phishing emails/texts mimic logistics carriers (UPS, FedEx, USPS) with links to “reschedule delivery” or “download invoice,” but the links install malware or harvest credentials.

Prevention: Train employees: never click links in unexpected delivery-or-shipment emails. Instead, navigate directly to the carrier’s site or use saved bookmarks.

**4. Malicious “Holiday Party” Attachments

**The scam: Unexpected attachments like “Holiday_Schedule.pdf” or “Party_List.xls” contain hidden macros or malware. Once opened, they can enable lateral access or exfiltration.

Prevention: Disable macros by default, scan all attachments, and build a culture of verifying any file received unexpectedly.

**5. Bogus Holiday Fundraisers

**The scam: Phishing sites mimic charities, ask for donation matching or “internal campaign” contributions; the money (or data) goes directly to criminals.

Prevention: Publish an approved list of charities each year. Require that any donation flows through your official donation system or portal—not via a forwarded link from an email.

Why These Attacks Work (And the Compliance Angle)

Your productivity tools—email, vendor portals, online banking—are the same channels criminals exploit. According to the FBI, BEC is one of the most financially damaging online crimes.

Even small and midsize companies under-invest in the human layer. Organizations that conduct regular phishing simulations reduce their risk significantly—yet many SMBs skip this step. Meanwhile, multifactor authentication (MFA) can block ~99% of unauthorized logins, yet remains under-adopted.

From a compliance standpoint, frameworks like the NIST Cybersecurity Framework, the CIS Controls and regulatory rules such as the FTC Safeguards Rule or the PCI DSS all emphasize not just technical controls, but also training, policies and transaction-verification flows. Embedding these controls reduces the “holiday scam losses” risk aggressively.

Your Holiday Scam Losses Prevention Checklist

Before the year-end rush begins, act on these:

-

Two-Person Rule: Every financial transaction above your threshold (e.g., $5K) must be verbally confirmed with a second person via an alternate channel.

-

Gift-Card Policy: Formal policy that gift cards cannot be purchased via email/text requests from executives or vendors without in-person or confirmed approval.

-

Vendor/Banking Verification: If vendor or banking details change, call the known number already on file—not the one provided in the email.

-

MFA Everywhere: Enable multifactor authentication on all business-critical accounts (email, online banking, vendor portals, cloud services).

-

Employee Briefing: Host a quick training/huddle with your team summarizing the five scam types above and emphasizing holiday vigilance.

-

Phishing Simulation: If you haven’t run one lately, schedule a quick push-phish campaign now to test staff response and reinforce awareness.

-

For more best-practice cyber hygiene aligned to compliance frameworks, check out the resources at the Cybersecurity & Infrastructure Security Agency (CISA) site.

-

Curious how well your controls stack up? Schedule your free security assessment with us and let’s benchmark your gap-areas.

The Real Cost of Holiday Scam Losses

While the high-profile $60 million loss made headlines, smaller firms often feel the pain more. Lost hours, crushed productivity, regulatory scrutiny, spike in insurance premiums, client trust eroding—these are the intangible costs you rarely see on the balance sheet.

For example: the average cost per BEC incident climbed from around $74,723 in 2019 to $137,132 in 2023.

A mid-sized business losing $100K+ at year-end can derail marketing, payroll, maybe even next year’s growth plan. If you layer in compliance failures (HIPAA, PCI, CJIS etc.), the reputational risk is real.

Keep Your Holidays Merry — Not Messy

Your holiday season should be about growth, celebration, client outreach—not cleaning up fraud. A quick team-huddle, a handful of smart policies and some layered controls go a long way toward avoiding “holiday scam losses”.

Remember: the employee at Orion could have stopped a $60 million loss with a single verification phone call. With the right awareness and simple checks, your business can avoid being the next cautionary tale.

Want to make sure your team is locked down before the New Year? Book a 15-minute discovery call and we’ll walk you through practical steps tailored to your business. Because the best gift you give your business this season is peace of mind, free from holiday scam losses.