By now, most Social Security numbers (SSNs) — one of the most critical pieces of personal information in the U.S. — have found their way onto the dark web. Massive breaches at major companies, government sites, and even healthcare providers have exposed millions of SSNs to cybercriminals. If you’re wondering whether this really matters, the answer is a definitive yes.

Here’s why a compromised SSN is a big deal, how to check if yours has been leaked, and what to do next.

Why a Leaked Social Security Number Is a Serious Threat

Your SSN is a cornerstone of your identity. With just this one piece of information, a cybercriminal can:

-

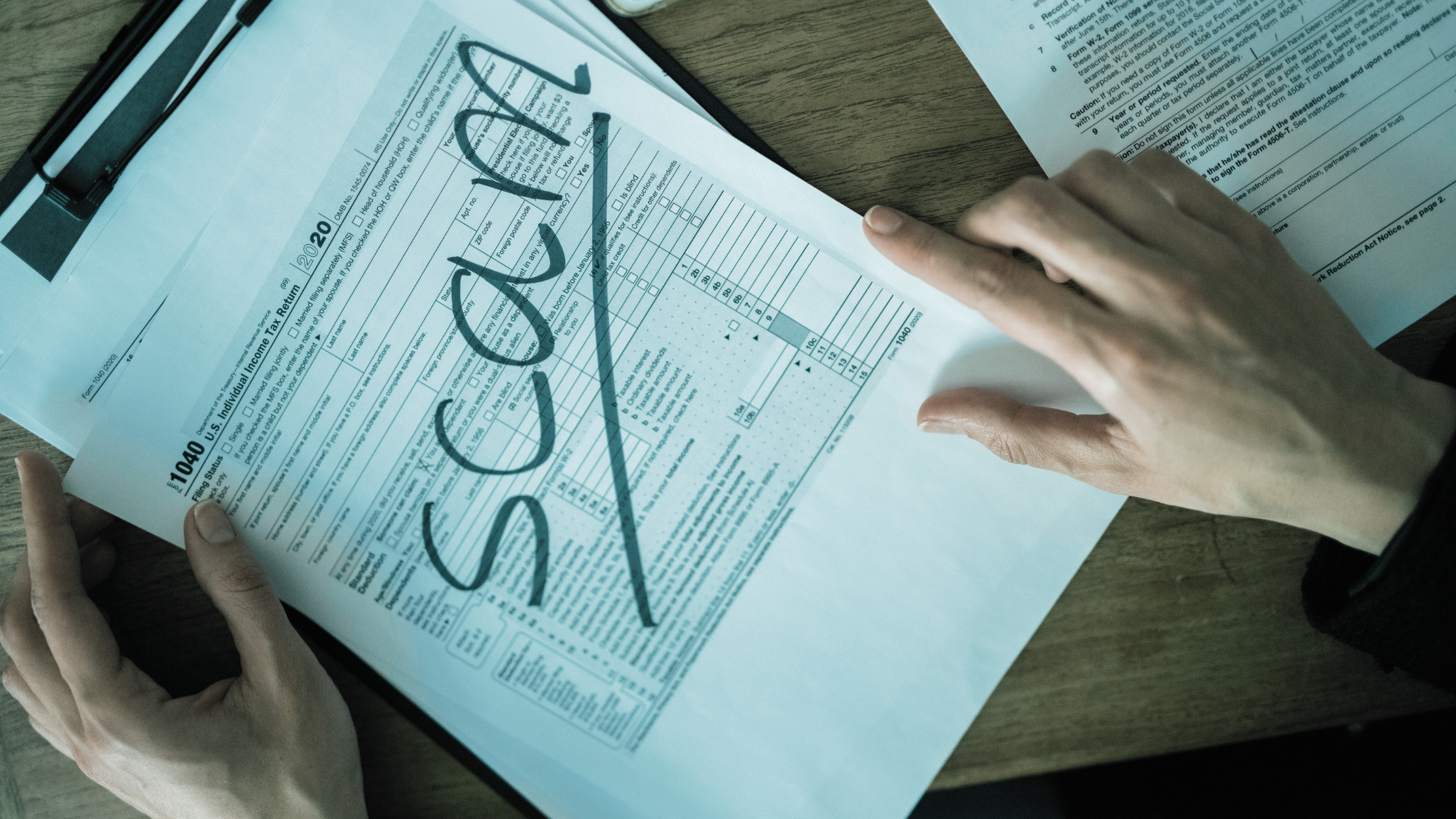

Steal Your Identity: Open credit accounts, take out loans, or file false tax returns in your name.

-

Commit Employment Fraud: Use your SSN to obtain a job, leaving you with unexpected tax issues.

-

Engage in Medical Fraud: Receive healthcare services under your name, creating false medical records that complicate your future care.

Criminals often hold on to stolen SSNs for years, waiting for the perfect time to exploit them. The 2017 Equifax data breach, which exposed SSNs of 147 million people, serves as a grim reminder. Victims faced fraudulent credit card applications, false tax returns, and financial chaos — some of which continues to this day.

How to Tell If Your Social Security Number Has Been Stolen

Look out for these warning signs:

-

Unexpected Mail: Receiving credit card offers, debt collection notices, or bills for accounts you didn’t open.

-

Credit Report Surprises: Spotting unfamiliar accounts or inquiries on your credit report.

-

Tax Return Issues: Being notified by the IRS of multiple tax returns filed under your name or being denied an expected refund.

-

Medical Billing Errors: Unfamiliar medical bills or strange entries in your medical records.

How to Check If Your SSN Has Been Leaked

1. Monitor Your Credit Reports

You’re entitled to a free annual credit report from each of the major credit bureaus: Experian, TransUnion, and Equifax. Regularly review these reports for suspicious activity.

2. Use Identity Theft Protection Services

Services like Experian IdentityWorks or LifeLock monitor your SSN and alert you to suspicious usage. While these services can’t prevent identity theft, they help you detect and respond to threats faster.

3. Freeze Your Credit

Freezing your credit is one of the most effective ways to prevent fraud. A credit freeze restricts access to your credit report, making it significantly harder for criminals to open accounts in your name. You can freeze and unfreeze your credit for free through the major credit bureaus.

4. Sign Up for SSN Alerts

The Social Security Administration offers alerts for certain activities, like changes to your Social Security account. These alerts won’t catch everything but can provide an extra layer of protection.

What to Do If Your SSN Is Leaked

If you’ve confirmed that your SSN has been compromised, act immediately:

-

File a Report with the FTC Visit IdentityTheft.gov to report the theft. The site will provide a recovery plan tailored to your situation.

-

Contact the Credit Bureaus Notify Experian, Equifax, and TransUnion. Request a fraud alert on your credit report to ensure lenders verify your identity before issuing credit.

-

Freeze Your Credit If you haven’t already, place a credit freeze to block unauthorized access to your credit report.

-

File a Police Report If the theft has caused financial loss or involves criminal activity, file a report with your local police department. This can serve as documentation when dealing with creditors.

-

Notify Financial Institutions Inform your bank and other financial institutions about the breach. They can monitor your accounts for suspicious activity and take additional security measures.

Protecting Your Business: Why Cybersecurity Is Critical

If you run a small or medium-sized business, safeguarding Social Security numbers and other sensitive data is crucial. A leaked SSN doesn’t just impact individuals; it can expose your business to:

- Legal Risks: Data breaches can lead to lawsuits and regulatory penalties.

-

Financial Loss: Cybercriminals may gain access to financial accounts.

-

Reputational Damage: Losing customer trust can have long-term consequences.

The solution? A comprehensive cybersecurity strategy. This includes:

-

Data Encryption: Protect sensitive information at rest and in transit.

-

Network Security: Secure your network against unauthorized access.

-

Employee Training: Educate your team on recognizing phishing attempts and other threats.

We’re Here to Help

At Iler Networking and Computing, we specialize in protecting businesses like yours from costly cyber threats. Our cybersecurity experts can help you safeguard sensitive data, ensure compliance, and give you peace of mind.

Call us at 440-322-4537 or Click here to schedule a FREE Security Risk Assessment and secure your business today.