Many small business owners still believe that regulatory compliance is a concern reserved for large enterprises. But in 2025, that thinking is not only outdated—it’s dangerous.

Many small business owners still believe that regulatory compliance is a concern reserved for large enterprises. But in 2025, that thinking is not only outdated—it’s dangerous.

With rising enforcement of data privacy and security regulations, compliance for small businesses is no longer optional. Failing to stay compliant can result in massive fines, lost clients, and irreparable reputation damage.

Why Compliance Matters More Than Ever in 2025

Regulatory agencies like the Department of Health and Human Services (HHS), the Federal Trade Commission (FTC), and the Payment Card Industry Security Standards Council (PCI SSC) are intensifying their scrutiny of small to mid-sized businesses.

What’s driving this? Increased cybercrime, rising concerns over data privacy, and a shift in liability from large corporations to any business handling sensitive data—no matter the size.

Noncompliance isn’t just a legal issue anymore. It’s a financial, operational, and brand-killing risk.

Key Regulations Affecting Small Businesses

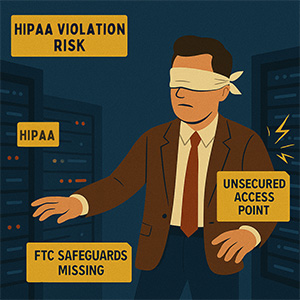

1. HIPAA (Health Insurance Portability and Accountability Act)

If your business handles protected health information (PHI)—even just through email or cloud storage—you’re on the hook for HIPAA compliance.

Recent updates now require:

-

End-to-end encryption of all electronic PHI

-

Regular security and risk assessments

-

Employee training on data handling protocols

-

A documented incident response plan

In 2024, a small healthcare provider was fined $1.5 million for failing to encrypt patient records. The organization nearly shut down.

2. PCI DSS (Payment Card Industry Data Security Standard)

Do you process credit card payments? Then PCI DSS applies to you. This standard demands:

-

Encrypted storage and transmission of cardholder data

-

Firewalls and anti-malware tools

-

Multi-factor authentication (MFA)

-

Ongoing network monitoring and testing

Noncompliance penalties can run $5,000 to $100,000 per month depending on the infraction’s scope.

3. FTC Safeguards Rule

This rule applies to businesses that collect financial information from consumers—including CPAs, law firms, and retailers. It mandates:

-

A written security plan

-

A designated compliance officer

-

Regular risk assessments and updates

-

MFA and secure access protocols

Violators face penalties of up to $100,000 per incident, and even personal liability fines of $10,000 for responsible staff.

What Happens If You Ignore Compliance?

These aren’t just theoretical consequences.

Consider a recent case where a small medical practice suffered a ransomware attack due to outdated antivirus software. The aftermath:

-

A $250,000 HIPAA fine

-

Legal action from patients

-

A 40% drop in patient volume due to lost trust

One oversight nearly sank the entire business.

5 Steps to Stay Compliant in 2025

-

Perform a Compliance Risk Assessment

Regularly review your network, data handling, and security protocols. -

Upgrade Your Security Stack

Use enterprise-grade firewalls, encryption, and MFA—not just basic antivirus. -

Educate Your Team

Train employees on phishing, data privacy, and industry-specific compliance risks. -

Create an Incident Response Plan

Know exactly what steps to take if a breach occurs. -

Work With Experts

Compliance is complicated. Partner with a trusted MSP (like us) to ensure you’re covered.

Don’t Wait Until It’s Too Late

The longer you delay, the more you risk. Fines, lawsuits, lost customers, and business shutdowns are all very real consequences of noncompliance.

Let’s make sure you’re not the next cautionary tale.

Book Your FREE Network & Compliance Assessment Now

We’ll help identify vulnerabilities in your system and make sure you’re up to date on HIPAA, PCI, and FTC requirements.

Bonus Tip: Check out this NIST guide on the privacy framework for small businesses—it’s a great starting point for those unsure of their responsibilities.